The Covid-19 pandemic dominated social and economic life in Germany and around the world in 2020 and also had a significant impact on the German bicycle and e-bike industry. The challenges for manufacturers and the bicycle trade were enormous against the backdrop of shutdowns, disrupted supply chains, shop closures, hygiene regulations, but also unprecedented demand.

The industry had already enjoyed dynamic growth in previous years. In turn, it became apparent that bicycles and e-bikes are not only extremely popular in Germany; they can be seen as a guarantor of infection-proof everyday mobility and thus relevant to the system. Two-wheelers, with and without electric drive, were and are the means of transport of the moment and were able to benefit greatly from the unprecedented situation of the past year.

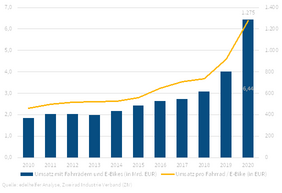

The economic data of the German bicycle industry for 2020 here in brief:

- Sales (in units) of bicycles and e-bikes in 2020 were up 16.9% on the previous year at 5.04 million units; E-bikes sales of 1.95 million units accounted for 38.7% of total sales, in 2020, 43.4% more e-bikes were sold than in 2019

- Sales (in euros) of bicycles and e-bikes reached the value of EURbn 6.44 in 2020, an increase of 60.9% compared to 2019

- Together with the components and accessories sector, this results in a sales volume of almost EURbn 10 across all sales channels

- The average sales price per bicycle (incl. e-bikes) was EUR 1,279 in 2020 compared to EUR 917 in the previous year and is dominated by the high share of e-bikes; five years ago the same value was still EUR 550

High model diversity in all product categories, outstanding design, innovative further development in drive and battery technology, e.g. the integration of the battery into the bicycle frame, and significantly greater usage options are to be seen as reasons for the boom in e-bike demand.

The business models of bike leasing and bike sharing are becoming increasingly popular. In particular, tax incentives for the purchase of e-bikes for commercial (cargo bikes) and professional use are having a positive impact. Exports of bicycles and e-bikes increased by 7.9% to 1.57 million units in 2020. E-bike exports alone increased to 0.61 million units, 15% above the previous year. The ZIV estimates that the total number of bicycles (incl. e-bikes) in Germany will increase to 79.1 million units in 2020; this already includes approx. 7.1 million e-bikes (9.0%).

Unit numbers grew in all model groups with the exception of non-electric MTBs, Dutch and touring bikes. Children's bikes and cargo bikes remained unchanged from the previous year. The following breakdown can be noted for e-bikes: E-trekking 35.5%, E-MTB 30%, E-city/Urban 28%, E-load bikes 4%, E-road bike 0.5% and fast E-bikes 0.5%. The E-MTB model group again grew significantly.

Source: edelhelfer analysis, Zweirad-Industrie-Verband (ZIV) (German Bicycle Industry Association)

Image: edelhelfer