Importance of sports aggregators is increasing

edelhelfer report “Market analysis – Sports aggregators in Germany” as of 03 April 2019

Sports aggregators show a growing presence in the German sports and fitness market. As a result, plant operators are increasingly asking whether they should enter into cooperation with one or more aggregators. The new edelhelfer study is intended to give an overview of the represented aggregators and thereby help in the decision.

The industry has long since adopted the original "one size fits all" approach over the past 20 years or so. Relatively new is the dissemination of an aggregated offer of individual sports and fitness offers, as a rule, by means of a membership, which was far better known in other areas. But even here, the beginnings go back much longer, at least in the corporate customer sector in the fitness industry. It is precisely this corporate fitness area and the willingness of companies to invest in the health of their employees that is also a major driver of aggregation or network offerings today.

According to Duden, an aggregator is a "service provider that selects, assembles, and offers to sell to customers." The client typically signs a contract with the aggregator, thereby gaining the right to either offer or summarize offers Service providers, often via membership programs. Well-known examples from other areas are food delivery services, hotel or flight booking platforms, and music or video streaming services.

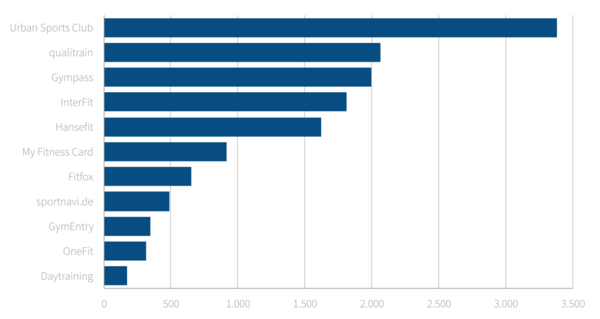

The largest providers in Germany according to the number of sports partners are currently Urban Sports Club, qualitrain, Gympass, InterFit and Hansefit. The individual providers differ both in their background and individual offer. With over 3,000 partners, the Urban Sports Club offers the largest network of sporting opportunities on the German market. Started in 2012 with a pure business-to-consumer offer, the company merged with the company fitness provider InterFit last year and will consolidate its leading position in the market after the integration has been completed. Approximately 2,000 systems are combined in this comparison, the second-placed company specialized in company fitness offers, qualitrain, which was acquired by eGym in 2018. The provider Gympass, which originated from South America and started at the end of 2015 in the German market, also has a comparable number of partner offers.

The largest providers in Germany according to the number of sports partners are currently Urban Sports Club, qualitrain, Gympass, InterFit and Hansefit. The individual providers differ both in their background and individual offer. With over 3,000 partners, the Urban Sports Club offers the largest network of sporting opportunities on the German market. Started in 2012 with a pure business-to-consumer offer, the company merged with the company fitness provider InterFit last year and will consolidate its leading position in the market after the integration has been completed. Approximately 2,000 systems are combined in this comparison, the second-placed company specialized in company fitness offers, qualitrain, which was acquired by eGym in 2018. The provider Gympass, which originated from South America and started at the end of 2015 in the German market, also has a comparable number of partner offers.

All these offerings have the advantage of simplifying product selection for the consumer, and in particular flexible access to a flexible variety of offers. But what are the advantages and disadvantages, or even better, the opportunities and risks of cooperation between the actual service providers and these aggregators? A question that also the different providers in the fitness industry (must).