Who gets us into shape in 2016?

edelhelfer report “Leading Operators – Fitness in Germany” as of 31 December 2015

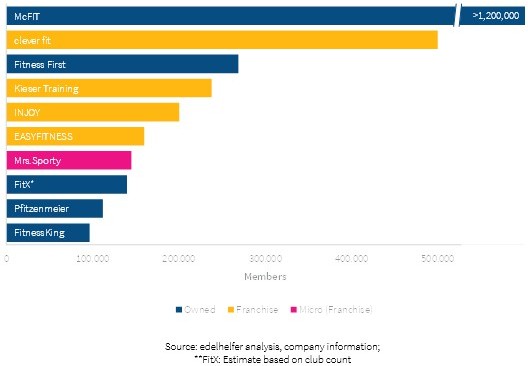

Demand for fitness in Germany is unbroken. This the major result of the current edelhelfer analysis of the leading health and fitness operators. According to the report, the ten largest fitness companies increased their total number of members by more than 10% to now 3.1 million in the past year. McFIT is still the largest provider with more than 1.2 million members in Germany. While the other budget chains have expanded their presence, even the non-budget operators were able to maintain their position in the market. In addition to the traditional health club concepts, also new opportunities for fitness activities are increasingly created, making the fitness market more versatile.

Currently, many follow their New Year’s resolution and close a membership contract at a gym. Thereby, club operators generate 15 to 20% of their new members in the first month of the year. “For us, the beginning of the year is an important time, but our ‘Home of Fitness’ concept, established in 2012, shows us that the new price-performance ratio excites our members and increases customer retention sustainably. In 2016, we will continue to develop the diversity of our action training and roll it out to our facilities," comments McFIT spokesman Pierre Geisensetter.

Also beyond January, the largest operators benefit from the continuing demand for fitness offerings. As the already fourth analysis of the leading fitness operators conducted by the advisory boutique edelhelfer shows, the top 10 operators united already 3.1 million members at the end of 2015, about one third of all gym members in Germany. Thus, the leading ten operators’ total membership grew by more than 10% in 2015.

McFIT remains by far the largest provider with more than 1.2 million members in Germany. In early 2015, it has established the new High5 concept with smaller clubs and monthly rates starting from EUR 9.90, and thereby offering the cheapest price in the market again. Previously, competitor FitX had entered the fitness market with monthly contracts at EUR 15 and had the strongest relative growth in members due to an increase in the number of clubs from 20 to 35 over the past year. The remaining budget operators Clever Fit, Easy Fitness and Fitness King all grew their membership numbers by at least 20% respectively.

The remaining non-budget operators in the Top10 were also able to keep their membership base and thus their market position stable. They followed different strategies in the competition for customers: Fitness First continues its Premiumisation with the development of higher quality Clubs, Kieser Training focuses on a broader expansion of its target group, Injoy develops more compact clubs within its "Station" concept and Mrs.Sporty integrates modern, web based equipment in its circuit training for women.

In addition to these larger traditional operators also a wide range of new offering concepts benefit from the increasing demand for health services.

The relatively young "CrossFit" offerings benefits especially from the still current trend of functional training. While the first club, also called "Box", was opened in 2008, today around 23,000 people exercise in more than 190 facilities in Germany, according to a recent publication by the fitness search engine Fitogram. Also emerged only in recent years, online offerings like SoMuchMore or Urban Sports Club offer a membership that enable the usage of a variety of fitness and wellness facilities within a city. Thus, they represent a new competition with their versatile range of offerings to the operators of individual clubs businesses.

More and more technical tools from so-called trackers counting steps, pulse and distance or the calorie consumption to complete suits produced by the startup Wearable Life Science, which allow electrical stimulation training outside the club, promise to help the buyer to get fit. Online fitness or diet programs offer options like "Get Sexy", "Get Extreme" or "Get light," and count on celebrities like Detelf D! Soost, Maria Höfl-Riesch or successful fitness blogger in their advertising.

For fitness market expert and managing director of edelhelfer Niels Gronau these offeirngs do not represent a significant threat to the traditional club operators. "The new offerings expand the market, making it more versatile and opening it for new target groups. From our point of view they could not replace the typical fitness club, but are rather an opportunity than risk for the traditional operators." And so, also the second largest provider Clever Fit bets on Instagram fitness phenomenon Sophia Thiel in his current campaign and promises together with her: "Bye Bye, inner ‘bastard’”, meaning to overcome the personal lack of will power.